The Atlanta Real Estate Report by ATLsherpa is a podcast & companion website for those interested in the Atlanta real estate market. This includes individual buyers, sellers and investors. It also includes architects, builders, developers, lenders, realtors and urban planners; anyone involved with the local real estate ecosystem.

In addition to the Substack app, this podcast is available on Spotify and Apple Podcast.

In this episode…

NOTE: This podcast consists of four separate segments and each has its own audio recording. The audio players appear under their respective segment headings. The length of the audio recording appears in brackets below. This post serves as an outline for the entire podcast and is integral to discussion.

Secular View: BUY ATL! [18:59]

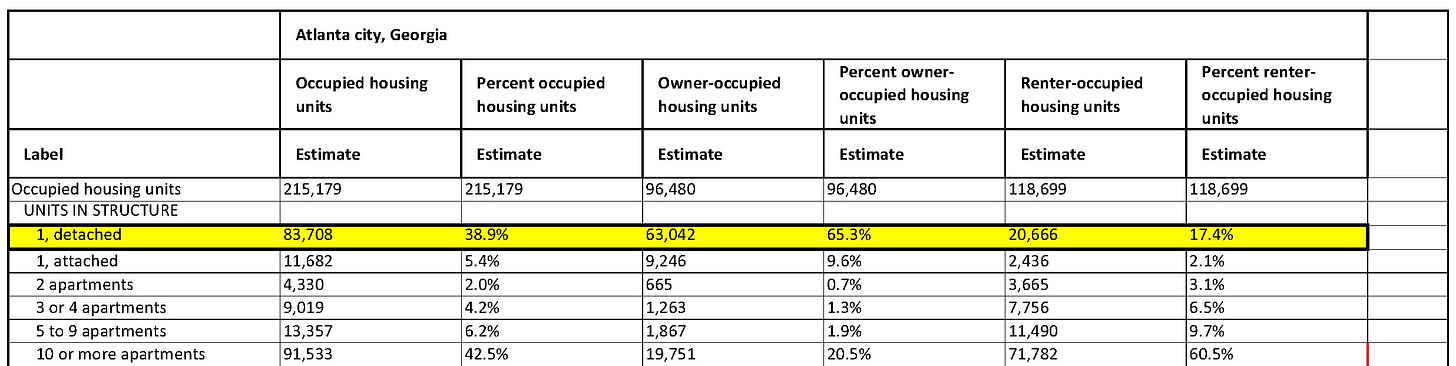

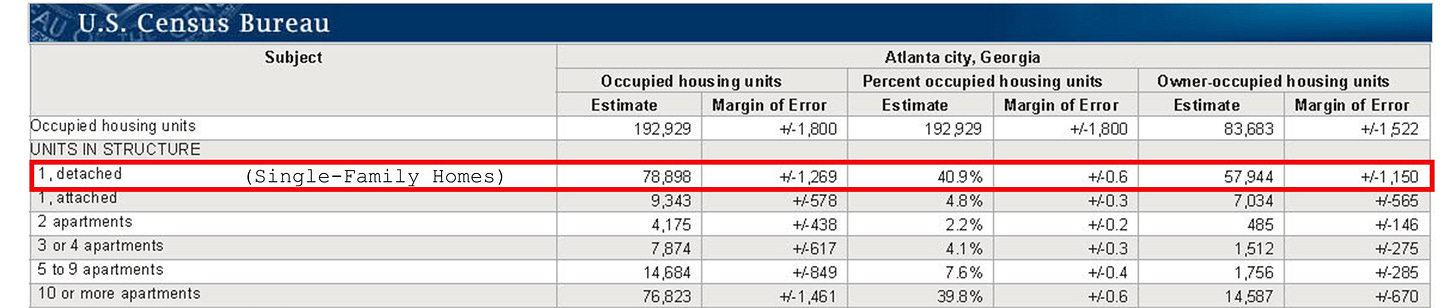

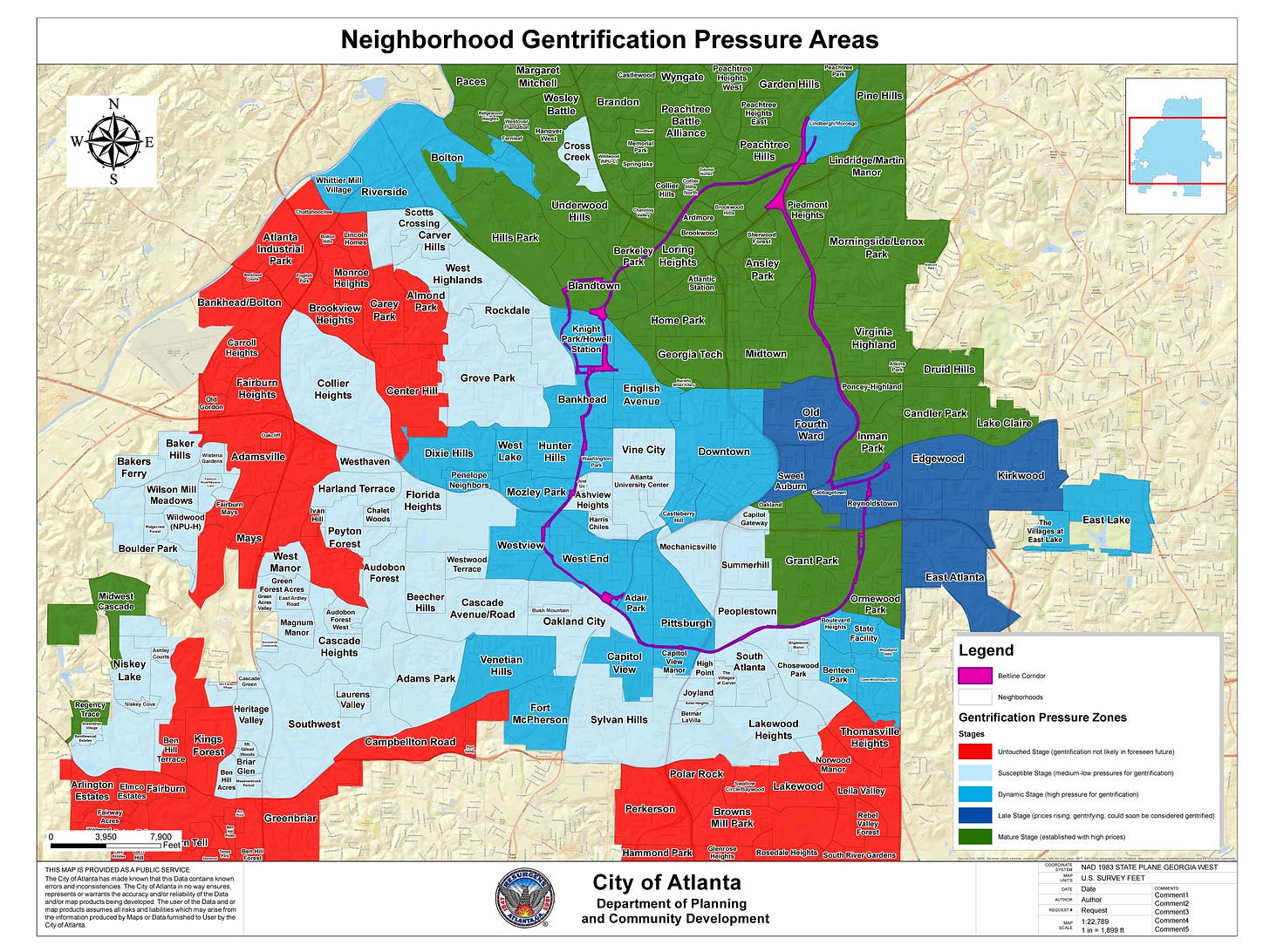

Atlanta Gentrification Map

Single-Family Homes: The “crown jewel” of residential real estate in the ATL [29:32]

Cautionary Notes

Demand Pull Forward: Newton’s Third Law of Motion

Cyclical View: Bubblicious [22:25]

Demand Pull Forward in the local housing market

The Fed Factor (still weighing on the markets)

Wealth Effect

Home Prices Roll Over

What can we expect in 2023? [17:37]

Lance Lambert — Fortune (interactive map)

John Burns — John Burns Real Estate (real estate cycle)

Ali Wolf — Zonda Home (deep dive into RRE industry)

Sheryl Palmer — Taylor Morrison (housing recession)

Jeff Blau — Related Companies (Office of the Future, zombie buildings, etc.)

Jonathan Gray — Blackstone (Univ of Cal $4B investment in BREIT)

Secular View: BUY ATL!

BUY ATL for the long-term (3+ years)

Perfect Storm (pandemic created a “Cat 5”)

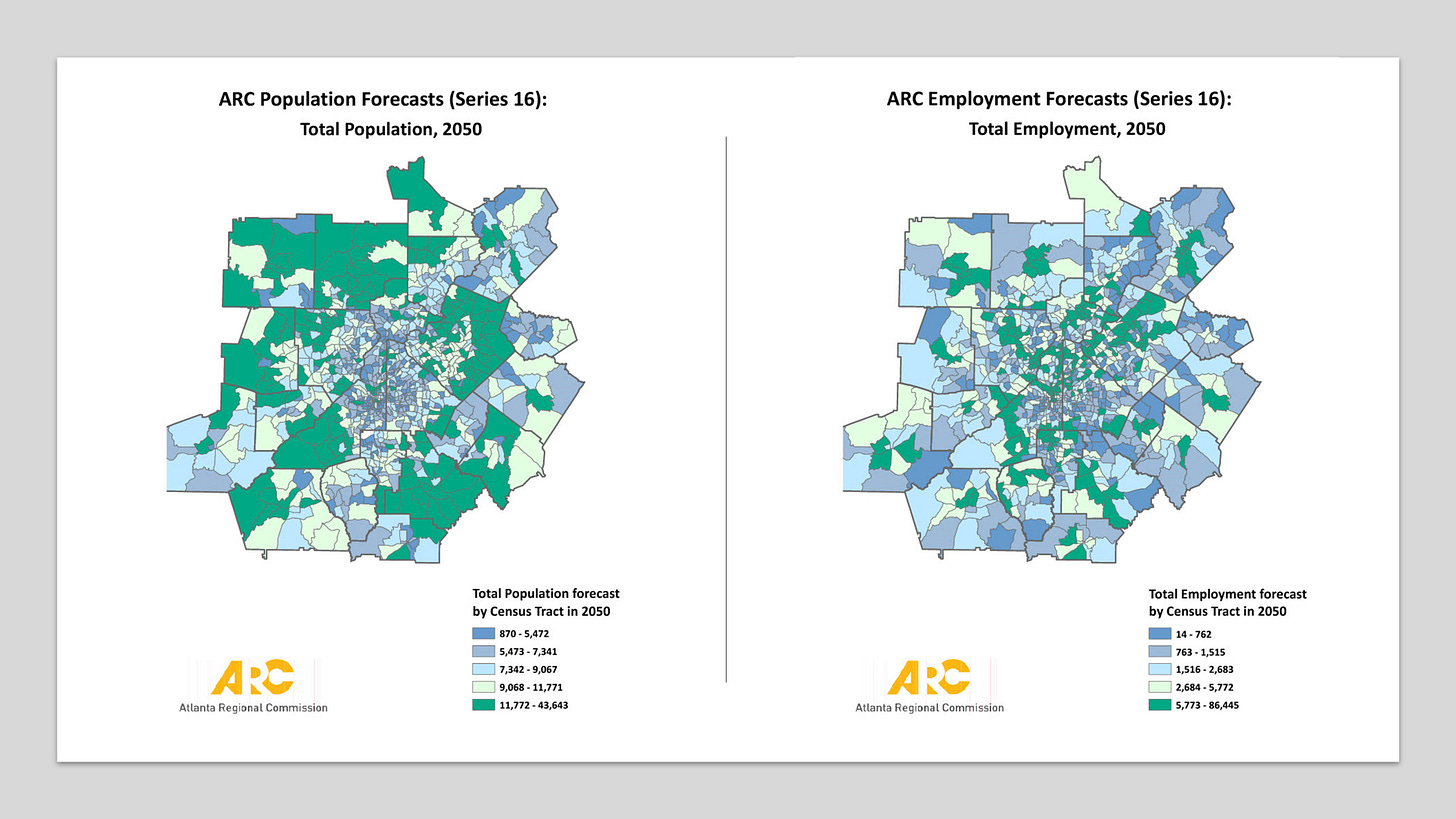

RE market is hyper local

City of ATL is a city of neighborhoods

Metro ATL is a region of cities / communities / subdivisions (suburbs & exurbs)

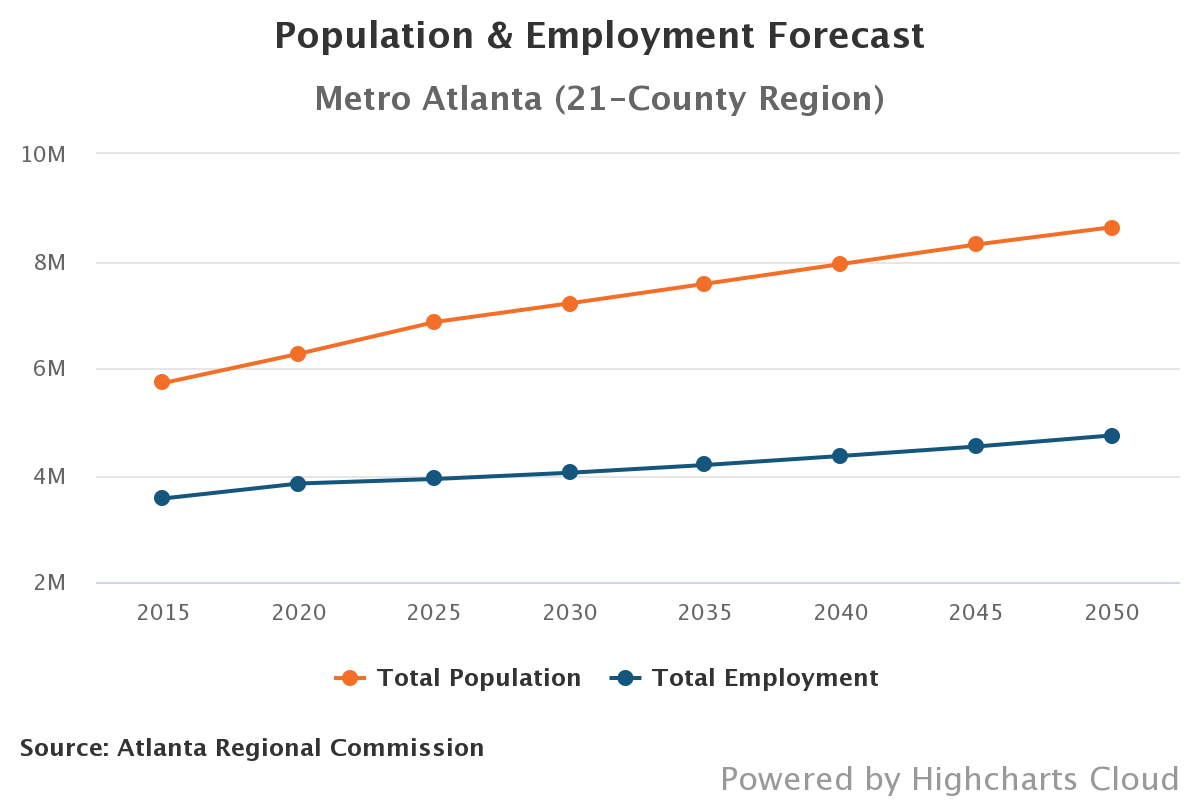

Population of 21-county region = 6.1 million

Population of City of Atlanta = 500,000

SFHs offer the best appreciation potential

See also…

Perfect Storm — June 2018

Game-Changers: 10 Projects that are Transforming ATL Right Now — 2019

How long will the ATL housing boom continue? — Dec 2020

Microsoft: Generational Game-Changer for ATL — May 2021

Imperfect Storm: Cat 5 Housing Market Cools to a Cat 3 — Nov 2022

Wall Street Meets Main Street — Dec 2022

Single-Family Homes: The “crown jewel” of residential real estate in the ATL…

Cautionary Notes…

Demand Drivers are secular and powerful, albeit variable*

Extreme volatility and uncertainty* (makes forecasting more difficult than usual)

Pandemic Effect: Years of demand “pulled forward” (wealth effect)

Economic headwinds (recession, layoffs, etc.)

Black swan events (aka, What could go wrong?)

(*) I discussed these at length in my last podcast

Demand Pull Forward: Newton’s Third Law of Motion

“For every action in nature, there is an equal and opposite reaction.”

Sir Isaac Newton’s Third Law of Motion — 1686 @ 23 years old

Cyclical View: Bubblicious

Demand Pull Forward in the Local Housing Market

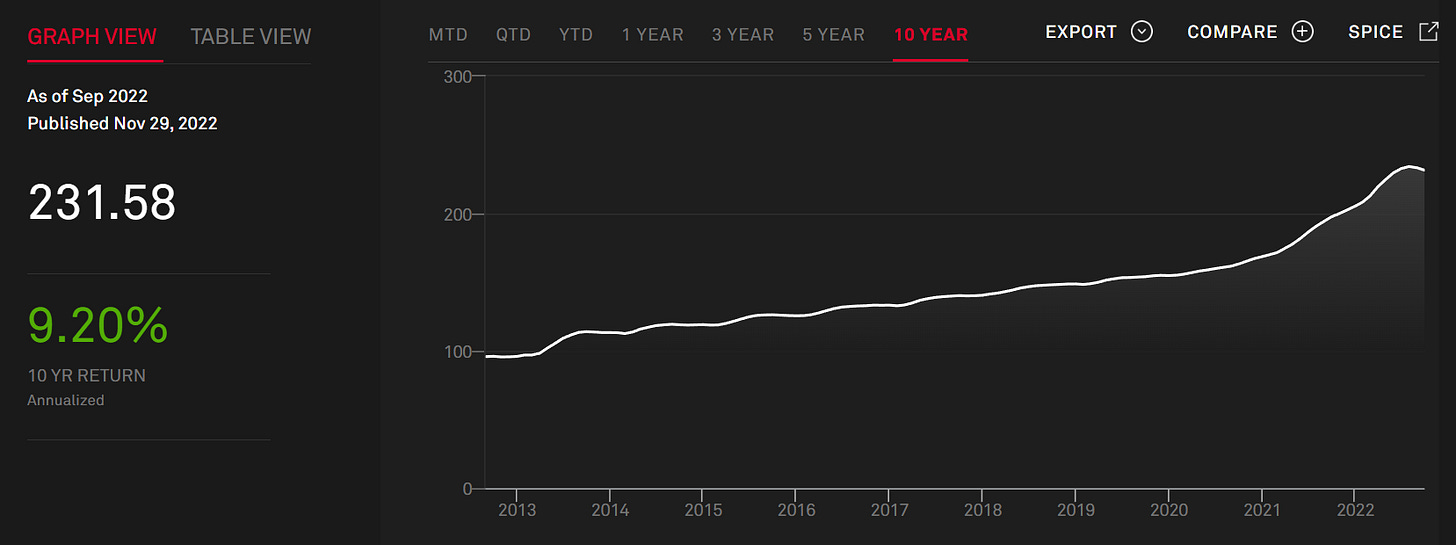

The House Price Index in the ATL MSA bottomed in Q2/2012 at 132.14. At the end of Q3/2022, the index stood at 344.83 (~16% per year)

The S&P/Case-Shiller U.S. National Home Price Index rose ~13% per year during that same time (ATL: +3% vs USA)

From Q2/2012 to Q2/2020 (start of pandemic) the ATL index increased 9.5% per year (132.14 to 232.25)

From Q2/2020 (start of pandemic) to Q3/2022 the ATL index increased 24.5% per year (232.25 to 344.83)

What does “normalization” mean?

Reversion to the mean

The Fed Factor (still weighing on the markets)

While speaking at a Brookings Institute event on Tuesday, Fed Chair Jerome Powell said the run-up in home prices during the Pandemic Housing Boom qualifies a "housing bubble."

“Coming out of the pandemic, [mortgage] rates were very low, people wanted to buy houses, they wanted to get out of the cities and buy houses in the suburbs because of COVID. So you really had a housing bubble, you had housing prices going up [at] very unsustainable levels and overheating and that kind of thing," Powell said. "So, now the housing market will go through the other side of that and hopefully come out in a better place between supply and demand."

The Pandemic Housing Boom did indeed see housing fundamentals get out-of-whack. According to Moody's Analytics, the average U.S. housing market was "overvalued" by 1% in the second quarter of 2019. Through the second quarter of 2022, the average U.S. housing market was "overvalued" around 25%.

@LanceLambert — Fortune Magazine, December 3, 2023

Wealth Effect

Over the past two years, Americans who own their homes have gained more than $6 trillion in housing wealth. To be clear, that doesn’t mean home builders have transferred to buyers $6 trillion worth of new housing, or that existing homeowners have made $6 trillion in kitchen and bathroom upgrades. Rather, most of this money has been created by the simple fact that housing, in short supply and high demand across America, has appreciated at record pace during the pandemic. Millions of people — broadly spread among the 65 percent of American households who own their home — have gained a share of this windfall.

Source: New York Times (May 2022)

Home Prices Roll Over

What can we expect in 2023?

Back in May, Moody's Analytics chief economist Mark Zandi told Fortune that the Federal Reserve's inflation fight would see the U.S. housing market slip into a "housing correction." At the time, he expected home prices to flat line nationally and fall between 5% to 10% in "significantly overvalued" markets. Zandi, of course, was right about the housing correction. That correction has actually been so sharp that Moody's Analytics in October once again lowered its national home price outlook. Peak-to-trough, Zandi expects U.S. home prices to fall 10%. If a recession does manifest, that outlook shifts down to a 20% peak-to-trough decline.

Atlanta, Charlotte, Indianapolis, Orlando, and Tampa experienced significant home price appreciation, in-migration, and job growth during the pandemic (prompted by buyers searching for affordability). Conversely, higher mortgage rates and slower economic growth have caused buyers to drop out of the qualified buyer pool or pause their home search until there is less uncertainty around the economy.

Markets in the “Plateauing” phase have seen significant capital investment over the past 12–24 months and are now faced with limited volume growth and decelerating home price appreciation, leading to shrinking capital returns, or underwriting becoming extremely aggressive in order for deals to pencil.

Zonda Home Chief Economist Ali Wolf gives a State of the Union with an update on housing activity and current economic trends. Market experts provide a closer look at Atlanta, Raleigh, and Charlotte's opportunities and challenges…

A housing recession has been underway for months, says Sheryl Palmer CEO Taylor Morrison…

Jeff Blau, CEO of Related Companies, on what companies are looking for in office buildings moving forward, what's selling, what's leasing, and what's not. He discusses the office sector at 1:48 in the video…

Blackstone Group Inc. President Jonathan Gray discusses the University of California's investment in his firm's Blackstone Real Estate Income Trust, investment strategy, and Federal Reserve policy…

On December 1, 2022, Blackstone Inc.’s $69 billion real estate fund for wealthy individuals (BREIT) said it will limit redemption requests, one of the most dramatic signs of a pullback at a top profit driver for the firm and a chilling indicator for the property industry. Source: Bloomberg