Welcome to the Atlanta Real Estate Report

The Atlanta Real Estate Report by ATLsherpa is a podcast & companion website for those interested in the Atlanta real estate market. This includes individual buyers, sellers and investors. It also includes architects, builders, developers, lenders, realtors and urban planners; anyone involved with the local real estate ecosystem. In addition to the Substack app, this podcast is available on Spotify and Apple Podcast.

In this episode…

Timestamps appear below in case you want to jump to specific topics…

Perfect Storm 3.0: Update on the ten demand drivers [03:40]

Weather Forecast: Perfect storm weakens to Cat 3 [30:20]

Supply & Demand: More here than meets the proverbial thinking [44:45]

Monetary & Fiscal Policy: Topic de jour by Chef Jerome [58:26]

Perfect Storm 3.0: Update on the ten demand drivers [audio: 03:40]

Perfect Storm: Why the Atlanta Real Estate Market is Booming — June 2018

How long will the ATL housing boom continue? — December 2020

Imperfect Storm: Cat 5 Housing Market Cools to a Cat 3 — November 2022

“Atlanta has been a pretty popular place to live since 1837, when a fledgling railroad town called Terminus was formed. However, nothing compares to what is happening in Atlanta today when it comes to real estate. A confluence of events has created a "perfect storm" in the Atlanta real estate market. The result can be described as a huge gap between the supply of homes and the demand for them. This explains why we have seen an unprecedented increase in real estate prices since the economic downturn of 2008 - 2012. Here are some of the drivers that have created this rare economic event...”

"Perfect Storm: Why the Atlanta Real Estate Market is Booming" — June 2018

Demand Drivers

Location

Population (ES)

Lifestyle (ES)

Demographics

Diversity

Atlanta BeltLine (ES)

Quality of Life

Transportation (ES)

Higher Education

Jobs (ES)

Recent Notes & Observations

All ten drivers are structural in nature. Strong, long-term trends.

Some drivers are more economically sensitive (ES) than others, which leads to variable demand.

The pandemic accelerated the impact of most of these drivers, leading to a temporary demand surge.

Self-fulfilling prophecy and flywheel effects are at play here.

Volatility has become extreme, which makes forecasting more challenging. It also increases the probability of overshoots and undershoots.

“In summary, the ten drivers described above have created a unique and powerful economic event. Remember that these are structural trends; not cyclical ones. The supply and demand imbalance for housing should last for decades. Will there be corrections along the way? No question about it; but the long-term trend is decidedly UP! Those who are in a position to purchase or invest in Atlanta real estate will have an opportunity to create generational wealth.”

“How long will the ATL housing boom continue?” — December 2020

Weather Forecast: Perfect storm weakens to Cat 3 [audio: 30:20]

The Atlanta real estate market is hyper-localized, which simply means that current and future market conditions can vary greatly from one neighborhood to another. That said, Atlanta is a dynamic metropolis with a robust economy that is inextricably linked to the economies of other cities, both domestic and international. The ATL economy is integrally connected to global industries such as film, healthcare, technology, tourism, transportation and logistics. As the state capital, Atlanta is co-dependent on a diverse state economy, that is evolving and thriving in its own right.

As such, the Atlanta real estate market is and will continue to be influenced by cyclical events and structural trends that are occurring around the world and within specific industries. My mission, with the Atlanta Real Estate Report, is to help you keep up with and make sense of those events and trends.

Current Conditions

Homebuilders say they’re on the edge of a steeper downturn as buyers pull back…

This presentation by Zonda Home (their clients are builders) provides some interesting insights about the Atlanta housing market…

Forecast

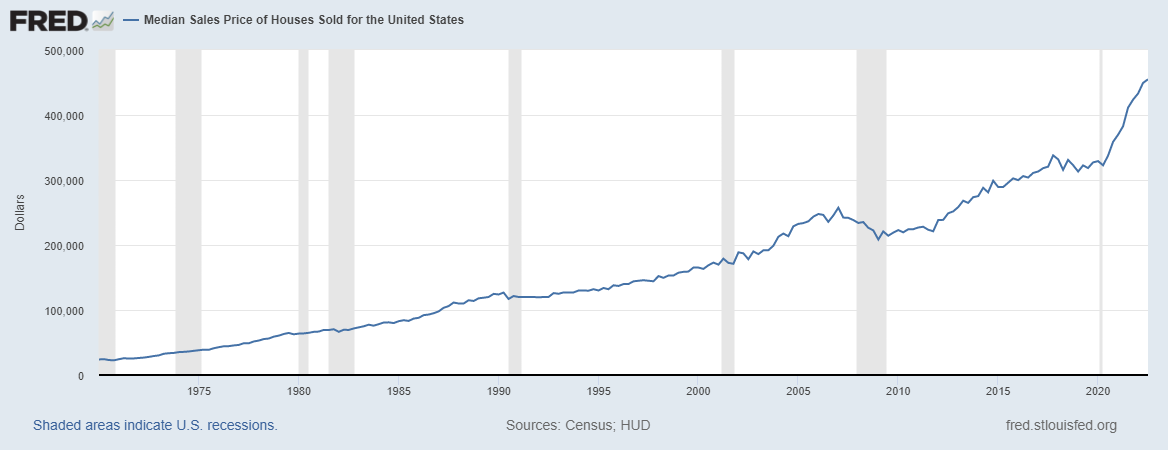

Now that the U.S. housing market has entered into a recession, it raises the question: What’s coming next for home prices? On Tuesday, the Case-Shiller U.S. National Home Price Index will report home prices grew at a double-digit rate between May 2021 and May 2022. However, that data is lagged. The real story, industry insiders say, is one of sharp decelerating price growth. By this time next year, McBride predicts home prices could be up 0% on a year-over-year basis. (Freddie Mac disagrees and says national house prices are set to rise another 4.4%.)

Regardless of where national house prices go next, it won’t be even across the nation. Already, markets like Boise and Phoenix are contracting significantly faster than the rest of the nation.

To get an idea of what might be on the horizon regionally, Fortune reached out to CoreLogic to see if the firm would provide us with its assessment of the nation’s largest regional housing markets. To determine the likelihood of regional home prices dropping, CoreLogic assessed factors like income growth projections, unemployment forecasts, consumer confidence, debt-to-income ratios, affordability, mortgage rates, and inventory levels. Then CoreLogic put regional housing markets into one of five categories, grouped by the likelihood that home prices in that particular market will fall over the coming 12 months.

Source: Falling home prices? This interactive map shows the statistical odds of it occurring in your local housing market — Lance Lambert, Fortune (July 2022)

Local Weather

Industry veteran, Katie Schanck, shares some insights about the current and future state of the Atlanta real estate market…

Supply & Demand: More here than meets the proverbial thinking [audio: 44:45]

Both are variable because they are economically sensitive

Demand ultimately determines price (buyers = transactions)

Pandemic altered and accelerated demand, which led to supply/demand imbalance and temporary price surge

What happens when demand and supply both plunge?

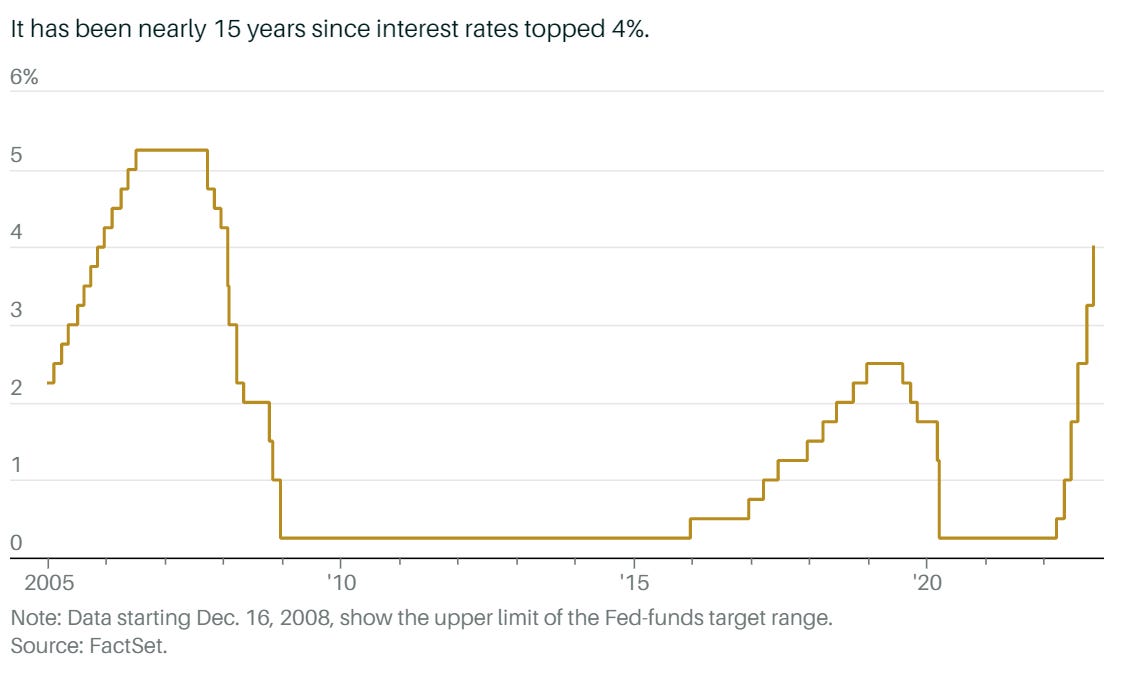

Thanks to the surge in mortgage rates, we've seen a historic collapse in mortgage affordability. New homebuyers are facing a massive sticker shock relative to what they could have paid just six months ago. So does this mean that house prices are due for a crash? On this episode of Odd Lots, we speak with Morgan Stanley housing strategist Jim Egan about what comes next. Egan argues that while high mortgage rates will discourage buyers, there won't be a significant unlocking of supply, since very few people will be forced to sell. It will be housing activity that sees the biggest change.

Source: “This Is What 7% Mortgages Will Do to the Housing Market” (Bloomberg)

Topics discussed in this podcast…

How unusual is the housing market right now — 3:55?

Will house prices crash as rates rise? — 5:40

The lock-in effect in housing — 8:16

On credit availability — 10:46

The importance of inventory — 14:04

Will more homes get built? — 18:04

The role of baby boomers in US housing — 21:48

Could we see big price declines? — 25:15

How do higher rates feed into mortgages? — 28:20

Is anyone refinancing now? — 21:13

What happened to MBS buyers? — 33:28

What is household formation? — 26:57

On Demographics…

From a demographic perspective on the housing market, we spend a lot of time talking about Millennials and Gen Z and the demand that they're going to represent as they roll through. We do think that you need to start focusing on the baby boomers. When we look at the percentage of homes owned by people over the age of 65, from 1980 to 2012, it is a very consistent number. It's roughly 25% of the housing stock. It oscillates between 24% and 26%. From 2012 to today, it's gone from 25% to roughly 33%. One out of every three homes in this country is held by somebody over the age of 65. When we look at how long they've owned those homes, over 50% of them, roughly 54%, moved in before the year 2000.

Now, the counterargument there is aging in place. That trend has happened a lot more frequently. People are living longer, they're living in their homes longer. We don't expect this supply to be a factor in our price forecasts for at least another decade. But if that were to come up sooner, that's where we kind of get into more of a bear case, and that would provide more pressure on home prices than we're currently expecting.

Source: “This Is What 7% Mortgages Will Do to the Housing Market” (Bloomberg)

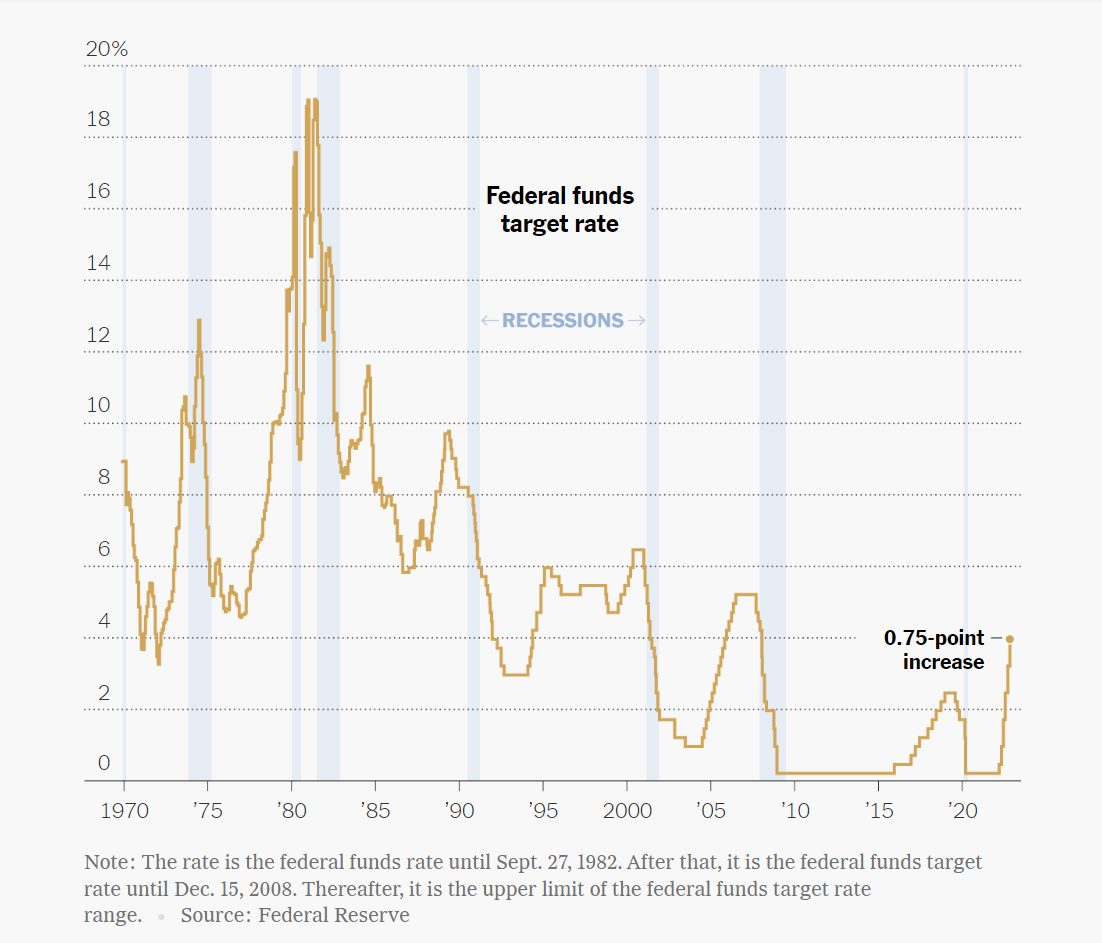

Monetary & Fiscal Policy: Topic de jour by Chef Jerome [audio: 58:26]

Monetary Policy

Refers to the actions of central banks to achieve macroeconomic policy objectives such as price stability, full employment, and stable economic growth.

“We have both the tools we need and the resolve to bring back price stability,” Jerome Powell, Chairman of the Federal Reserve

A decline in rent prices is 'well out' from where we are now, says Fed Chair Powell…

Fiscal Policy

Refers to the tax and spending policies of the federal government. Fiscal policy decisions are determined by the Congress and the Administration; the Fed plays no role in determining fiscal policy.

The Fed

The U.S. Congress established maximum employment and price stability as the macroeconomic objectives for the Federal Reserve (aka, The Fed); they are sometimes referred to as the Federal Reserve's dual mandate.

The monetary policymaking body within the Federal Reserve System is the Federal Open Market Committee (FOMC). The FOMC currently has eight scheduled meetings per year, during which it reviews economic and financial developments and determines the appropriate stance of monetary policy. In reviewing the economic outlook, the FOMC considers how the current and projected paths for fiscal policy might affect key macroeconomic variables such as gross domestic product growth, employment, and inflation. In this way, fiscal policy has an indirect effect on the conduct of monetary policy through its influence on the aggregate economy and the economic outlook. For example, if federal tax and spending programs are projected to boost economic growth, the Federal Reserve would assess how those programs would affect its key macroeconomic objectives--maximum employment and price stability--and make appropriate adjustments to its monetary policy tools.