This segment first appeared in the January 14 episode of the Atlanta Real Estate Report — ATL Housing Market: What can we expect in 2023 and beyond?

“For every action, there is an opposite and equal reaction.”

— Sir Isaac Netwon (1666)

Cyclical View: Bubblicious

Demand Pull Forward in the Local Housing Market

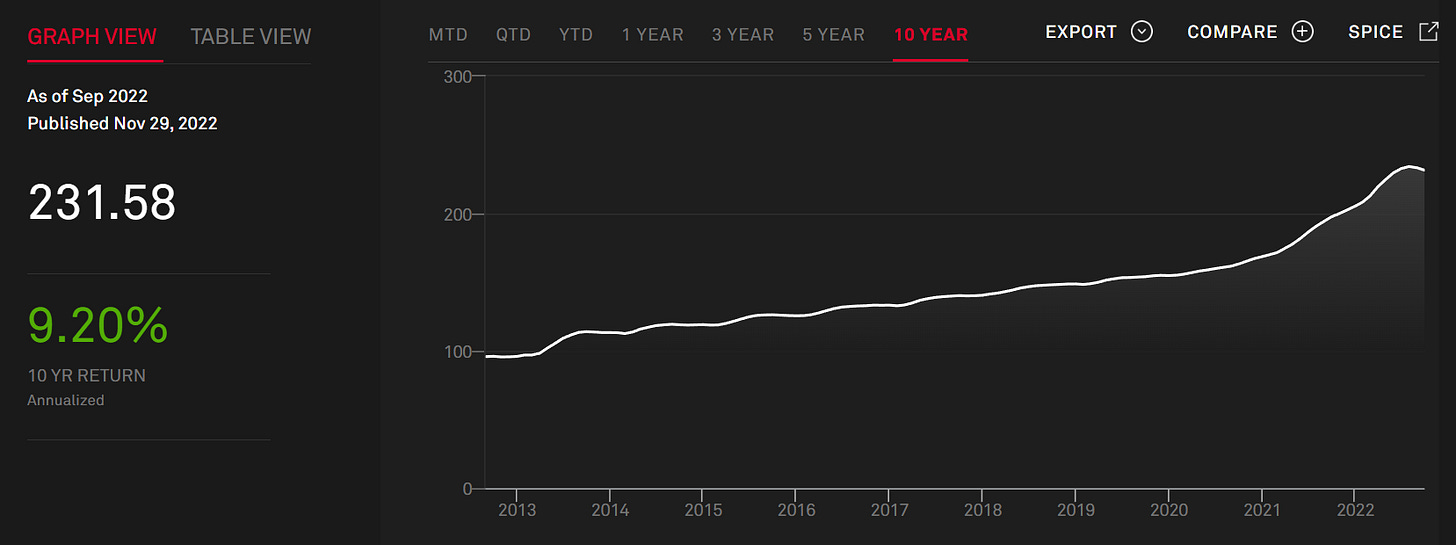

The House Price Index in the ATL MSA bottomed in Q2/2012 at 132.14. At the end of Q3/2022, the index stood at 344.83 (~16% per year)

The S&P/Case-Shiller U.S. National Home Price Index rose ~13% per year during that same time (ATL: +3% vs USA)

From Q2/2012 to Q2/2020 (start of pandemic) the ATL index increased 9.5% per year (132.14 to 232.25)

From Q2/2020 (start of pandemic) to Q3/2022 the ATL index increased 24.5% per year (232.25 to 344.83)

What does “normalization” mean?

Reversion to the mean

The Fed Factor (still weighing on the markets)

While speaking at a Brookings Institute event on Tuesday, Fed Chair Jerome Powell said the run-up in home prices during the Pandemic Housing Boom qualifies a "housing bubble."

“Coming out of the pandemic, [mortgage] rates were very low, people wanted to buy houses, they wanted to get out of the cities and buy houses in the suburbs because of COVID. So you really had a housing bubble, you had housing prices going up [at] very unsustainable levels and overheating and that kind of thing," Powell said. "So, now the housing market will go through the other side of that and hopefully come out in a better place between supply and demand."

The Pandemic Housing Boom did indeed see housing fundamentals get out-of-whack. According to Moody's Analytics, the average U.S. housing market was "overvalued" by 1% in the second quarter of 2019. Through the second quarter of 2022, the average U.S. housing market was "overvalued" around 25%.

@LanceLambert — Fortune Magazine, December 3, 2023

Wealth Effect

Over the past two years, Americans who own their homes have gained more than $6 trillion in housing wealth. To be clear, that doesn’t mean home builders have transferred to buyers $6 trillion worth of new housing, or that existing homeowners have made $6 trillion in kitchen and bathroom upgrades. Rather, most of this money has been created by the simple fact that housing, in short supply and high demand across America, has appreciated at record pace during the pandemic. Millions of people — broadly spread among the 65 percent of American households who own their home — have gained a share of this windfall.

Source: New York Times (May 2022)

Home Prices Roll Over