This segment first appeared in the 12/30/22 episode of the Atlanta Real Estate Report…

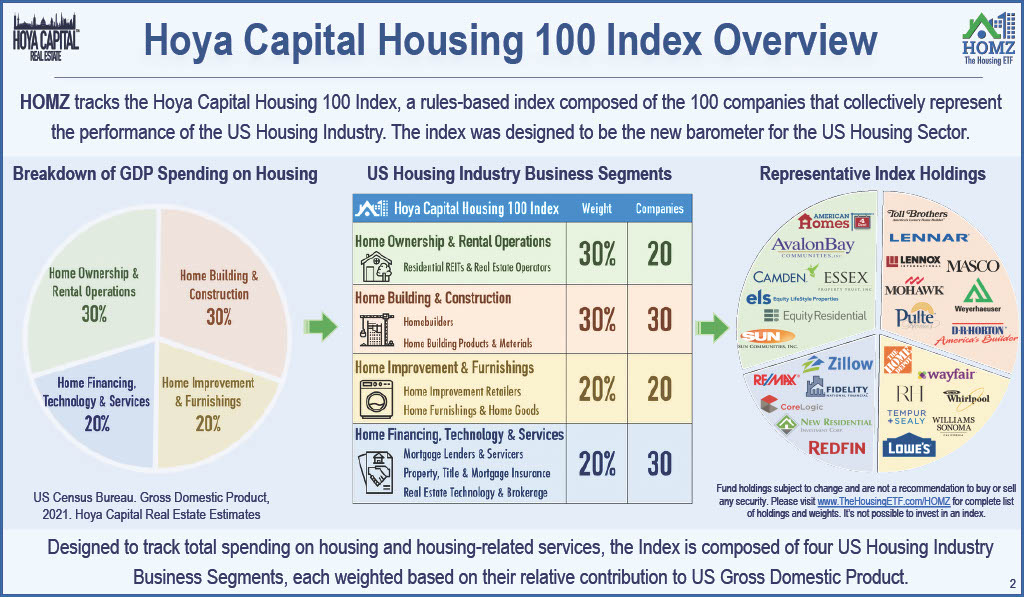

Let’s look at some publicly-traded companies in the housing sector…

Publicly-traded companies are the “fulcrum” between Wall Street and Main Street. They allow us to participate in the long-term growth of the real estate industry with a much lower investment than owning real property directly — and, in the case of rental property, with less headaches. They also allow us to focus our investment capital on very specific sectors and segments of the industry.

> > > Click on the company names below to access their investor relations pages…

Home Builders — DR Horton + Century Communities + Lennar + Pulte Group + Meritage + Taylor Morrison + Green Brick Partners + Toll Brothers + Beazer + LGI

Banks — Truist + Bank of America + Wells Fargo + Synovus + Ameris + United Community + JP Morgan Chase + Regions + South State + OZK

Mortgage — Rocket + United Wholesale + Loan Depot

Residential Brokerage — Anywhere + Berkshire Hathaway + Compass + + RE/MAX

iBuyers & Hybrids — eXp + Offerpad + Opendoor + Redfin + Zillow

Single-Family Home Rental — American Homes 4 Rent + Invitation Homes

Commercial — CBRE + Cushman & Wakefield + JLL + Colliers

Building Supplies — A.O. Smith + Carrier + Owens Corning + Home Depot + Mohawk Industries + Sherwin Williams

Home Furnishings — RH + Sonos + Lazy Boy + Sealy + Wayfair + Williams-Sonoma

Exchange Traded Funds (ETFs) — SPDR® S&P® Homebuilders ETF + iShares U.S. Home Construction ETF + Invesco Dynamic Building & Construction ETF + Hoya Capital Housing ETF

Real Estate Investment Trusts (REITs) — Separate topic / future episode

Public REITs own 535,000 properties across the U.S. as of year-end 2020.

Equity and mortgage REITs combined own roughly $3 trillion in gross real estate assets.

Private REITs own an additional $1.5 trillion in gross assets bringing the total REIT ownership value to $4.5 trillion in the U.S. as of year-end 2021.

U.S. REITs contributed the equivalent of an estimated 3.2 million full-time jobs to the economy in 2021 generating $229 billion of labor income.

REIT activities resulted in the distribution of $92.3 billion of dividend income in 2021.

Source: Nareit

NOTES:

Keep in mind that this a small sample of the PUBLIC companies that operate in the real estate industry. As such, they are some of the largest in their respective categories. These are HUGE companies. There are also thousands of PRIVATE companies (typically much smaller) that also contribute greatly to the real estate economy, especially in the way of builders, brokerage companies and mortgage companies.

Clicking on the company names will take you to their investor relations pages. Look for press releases, investor presentations, conference calls and webcasts.

The names listed under “Home Builders” and “Banks” are the Top 10 publicly traded companies operating in the Atlanta region for their respective categories. Note that these rankings may change from year to year.

The real estate “ecosystem” is dynamic and really interesting…

> > > Click on the images below to enlarge the charts…