This segment first appeared in the 12/30/22 episode of the Atlanta Real Estate Report…

How do these Wall Street companies impact Main Street?

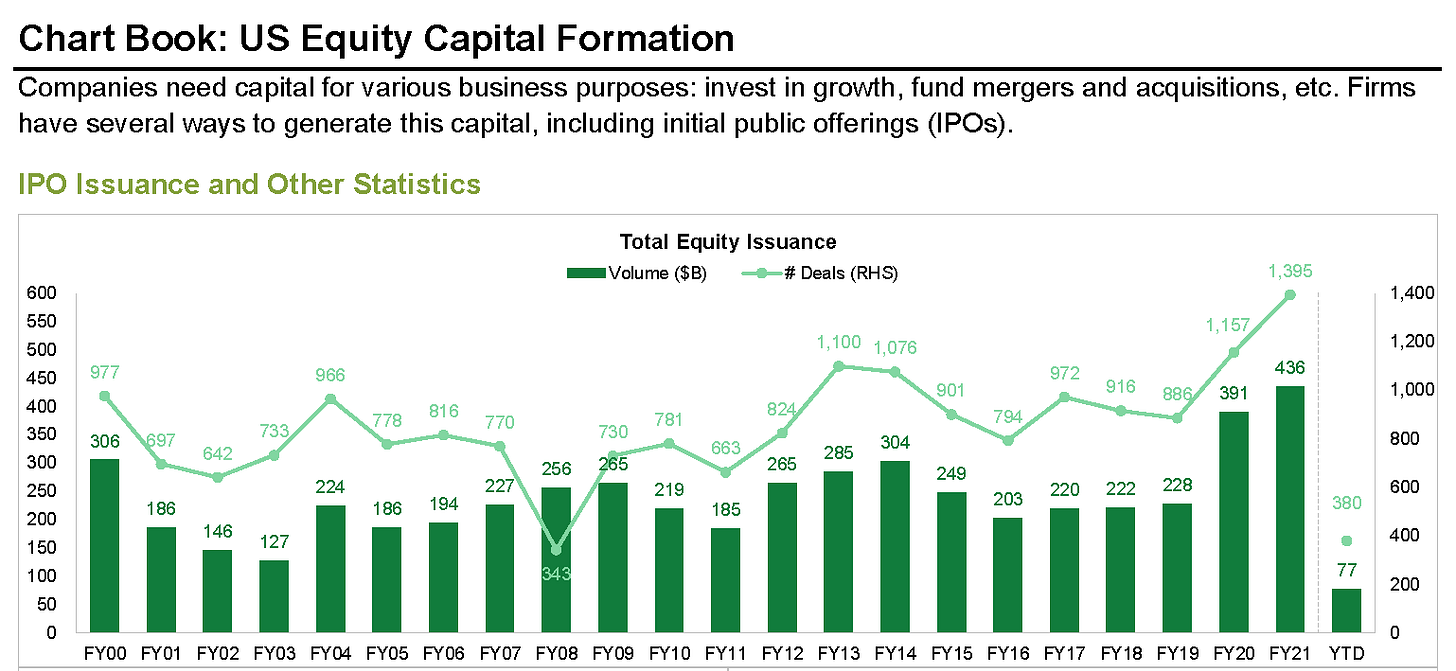

Access to capital

M&A activity

Economic impact

Wealth effect

Access to Capital

By tapping equity & debt markets

Use for expansion, R&D (innovation)

Going public in a bear market…

Timing is everything…

Mergers & Acquisitions

Public + private combos create a liquidity event at the local level (e.g., Green Brick + Providence Group, 2011)

Public + public combos seek to create diversification, scale and/or synergy (e.g., Home Depot + HD Supply, 2020) — MRO (Maintenance, Repair, and Operations)

Especially significant in CRE market (size)

Primarily REITs and public companies like Blackstone and Blackrock

Private equity, pension funds and foreign investors

Economic Impact

Huge multiplier effect

Residential Housing: 15-18% of GDP ($3.9 - 4.7 trillion) + 33% of consumer spending (Source: NAHP + Hoya Capital)

Commercial Real Estate: $1.2 trillion in GDP + $418.7 billion in salaries and wages (Source: NAIOP)

Commercial Real Estate: 8.5 million jobs

Construction employment = 7.6 million jobs (3.1M residential)

Construction jobs: ~300,000 to 400,000 per month

NOTE: Economic impact and employment data are for the entire real estate industry, which includes both public and private companies

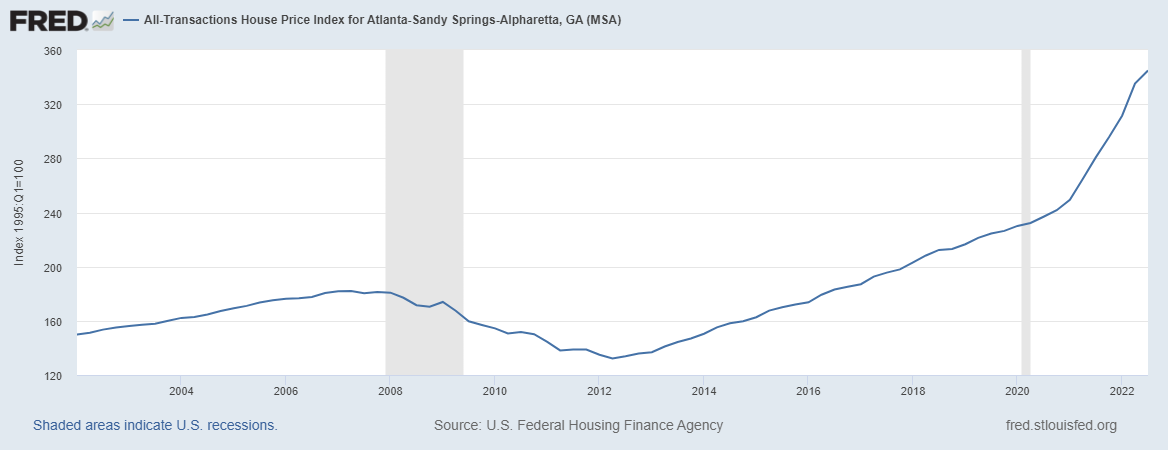

Wealth Effect

Equities = ownership = wealth creation

Bear markets lead to wealth destruction which, in turn, can lead to demand destruction (including real estate and related sub-sectors)

Stock prices affect consumer confidence which, in turn, impacts consumer spending

Most 401(k) plans invest in stocks