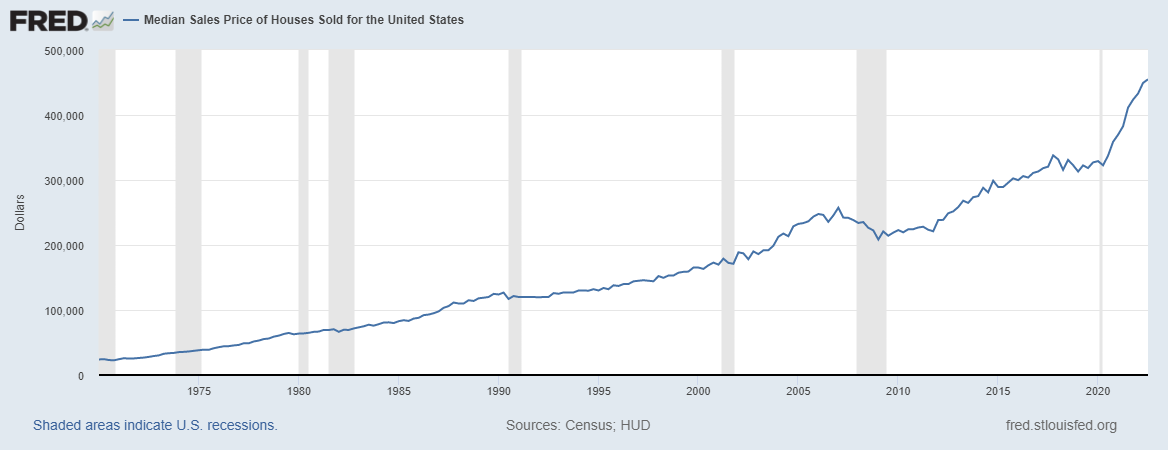

This segment first appeared in my November 2022 podcast entitled, Imperfect Storm: Cat 5 Housing Market Cools to a Cat 3…

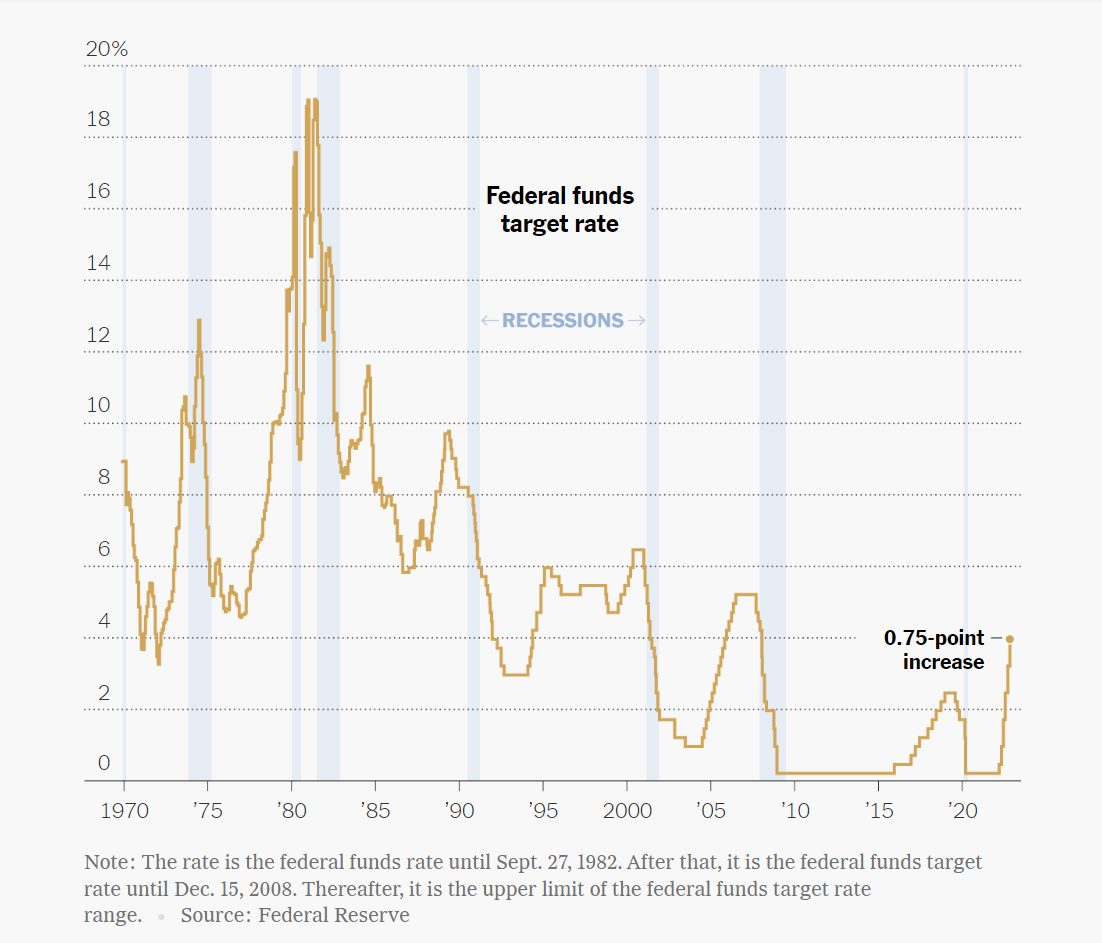

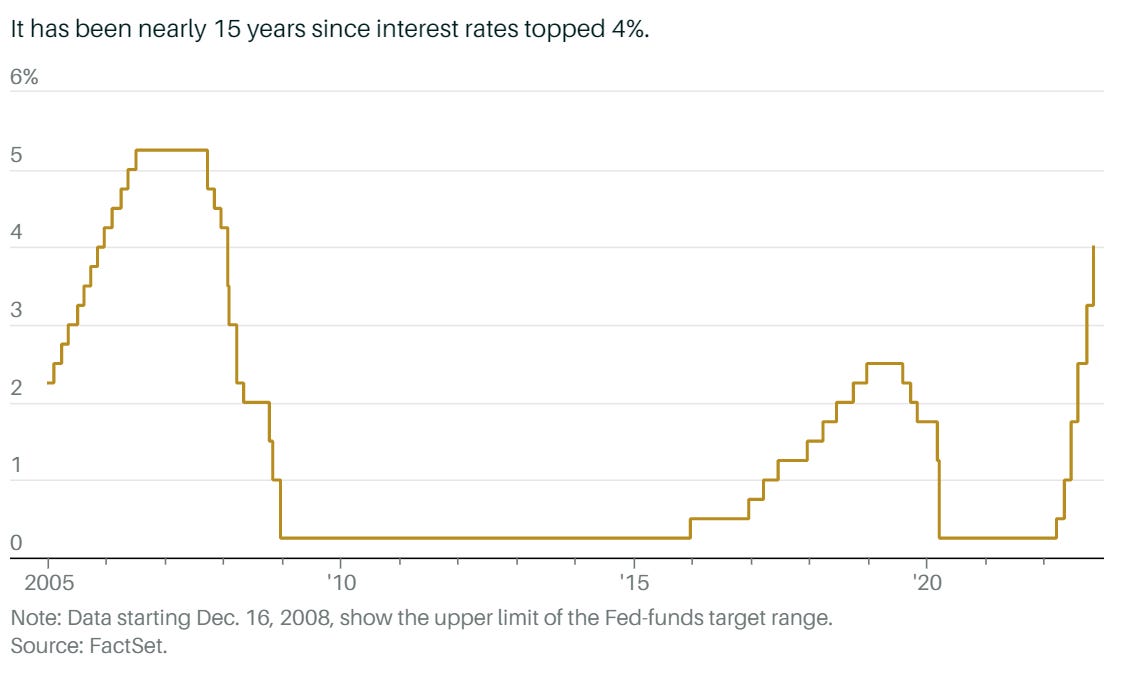

Monetary Policy

Refers to the actions of central banks to achieve macroeconomic policy objectives such as price stability, full employment, and stable economic growth.

“We have both the tools we need and the resolve to bring back price stability,” Jerome Powell, Chairman of the Federal Reserve

A decline in rent prices is 'well out' from where we are now, says Fed Chair Powell…

Fiscal Policy

Refers to the tax and spending policies of the federal government. Fiscal policy decisions are determined by the Congress and the Administration; the Fed plays no role in determining fiscal policy.

The Fed

The U.S. Congress established maximum employment and price stability as the macroeconomic objectives for the Federal Reserve (aka, The Fed); they are sometimes referred to as the Federal Reserve's dual mandate.

The monetary policymaking body within the Federal Reserve System is the Federal Open Market Committee (FOMC). The FOMC currently has eight scheduled meetings per year, during which it reviews economic and financial developments and determines the appropriate stance of monetary policy. In reviewing the economic outlook, the FOMC considers how the current and projected paths for fiscal policy might affect key macroeconomic variables such as gross domestic product growth, employment, and inflation. In this way, fiscal policy has an indirect effect on the conduct of monetary policy through its influence on the aggregate economy and the economic outlook. For example, if federal tax and spending programs are projected to boost economic growth, the Federal Reserve would assess how those programs would affect its key macroeconomic objectives--maximum employment and price stability--and make appropriate adjustments to its monetary policy tools.